[ad_1]

Finding out how one can make a money imaginative and prescient board will likely be extraordinarily helpful for financial administration. In relation to targets, the adage rings true: “Out of sight, out of ideas.” Nevertheless if you happen to occur to take the time to create a imaginative and prescient board, you’ll at all times be reminded of your targets.

As cited in Verywell Ideas, imaginative and prescient boards can improve success and mindfulness. Due to this, creating one might assist us maintain centered on working in the direction of our financial targets.

What’s a imaginative and prescient board?

A imaginative and prescient board is a collage of photos and phrases that depict belongings you’ll want to accomplish in your future. It’s a visual illustration of your hopes and targets. Its objective is to perform inspiration and motivation for working in the direction of your targets.

Being able to see exactly what you’ll want to accomplish presents you one factor to work in the direction of, fairly than merely letters on an online web page. In the end, although there’s nonetheless value in writing your money targets down, seeing is believing!

I personally create a money specific imaginative and prescient board yearly to keep up me centered on the money targets I would like to perform.

Why is a money imaginative and prescient board a very good suggestion?

If we give it some thought, most targets are linked to our funds not directly. Our dream dwelling, vehicle, and journey would require money. Having a money imaginative and prescient board might assist us maintain centered on attaining these points.

A money imaginative and prescient board is an effective idea on account of it’s designed to visualise your intentions for money. Whether or not or not it’s learn how to economize, paying off financial institution card debt fast, or rising your income, your ideas will likely be put into seen form.

Financial imaginative and prescient boards usually take advantage of charts (similar to a monetary financial savings goal thermometer) to hint progress. So in case your imaginative and prescient is to grow to be debt-free, likelihood is you may embody a debt payoff tracker in your financial imaginative and prescient board.

In relation to saving money, I actually like coloring in my monetary financial savings thermometer as I cross each monetary financial savings milestone that I’ve set for myself. Merely seeing this visualize strikes a chord in my memory of the progress I’m making.

Using a imaginative and prescient board to realize your money targets

Using a imaginative and prescient board in your financial targets is not any completely completely different from one other goal. Your entire degree is to create a bodily illustration of what you’ll want to accomplish. Do you have to’ve had a tricky time coping with money to date, possibly this pleasant practice will help maintain you motivated.

Plus, establishing a board in your money can merely be built-in into your financial planning course of. As you develop a plan, merely create a board to go together with it.

As an illustration, you’ll take into account it as the final word seal in your document of money intentions. Listed beneath are some steps that I personally use and uncover helpful. You presumably can leverage them to convey your imaginative and prescient board ideas to life:

1. Decide on a bodily or digital imaginative and prescient board

There are a variety of different methods to make a imaginative and prescient board.

As an illustration, you’ll go the old-school route by lowering out phrases and footage from earlier magazines, that’s my format of choice. Or you too can make a digital one using an on-line graphics software program, like Canva. Every decisions are free and/or very cheap, so it merely relies upon upon your non-public need.

Proper right here’s what you’ll need to create a bodily imaginative and prescient board:

- Poster board or cork board: Though most imaginative and prescient boards are photographs glued to a poster board, you might also use a cork board and tack photographs instead.

- Outdated magazines: You’ll use magazines to go looking out photographs, phrases, and completely different seen inspirations that characterize your targets. They’ll need to be earlier because you’ll be lowering points out. You would possibly have the ability to seize earlier editions of magazines out of your native library or consolation retailer with out value or at a decreased value.

- Your affirmations or inspiring quotes: These are phrases, phrases, and sentences that encourage, encourage, and present you learn how to give consideration to what you’ll receive.

- Photographs from on-line: Ought to you’ll be able to’t uncover earlier magazines, you’ll always uncover inspiration on-line. You presumably can print out photographs that you simply simply uncover applicable.

- Glue or tacks: You’ll need to connect or tack your photographs to your poster or corkboard. I prefer to advocate a glue stick if you happen to occur to’re using glue.

- Scissors: You may decrease out photographs in order so as to add to your board, so have a pair of scissors helpful.

Proper right here’s what you’ll need to create a digital imaginative and prescient board:

- Powerpoint, Keynote, your Notes app, or a graphics app like Canva

- Digital photographs

- Affirmations or inspiring quotes

2. Write down your financial intentions sooner than you start

Your intentions will possible be your foundation. So, the second step in figuring out how one can make a imaginative and prescient board is to jot down down your targets.

These targets should be very clear so that exactly what you’re making an attempt to carry out and the best way you’ll accomplish it. A technique to do this is by using the SMART targets approach.

This goal-development approach teaches you to create specific, measurable, attainable, life like, and properly timed targets. If you may need SMART targets, you’ll merely see what you’re working in the direction of.

As an illustration, my financial goal is also to “save $10,000 for emergencies by Dec 31, 202X.” This goal could also be very specific; its success will likely be measured; it is life like for me, and it has a timeframe.

Since this goal has a extremely clear description, discovering an applicable seen illustration will possible be easy.

It would not matter what your financial targets are, it’s important to clearly define them and write them down on paper sooner than you start getting creative and establishing your money imaginative and prescient board.

3. Ponder along with charts and graphs

Whether or not or not making a digital or a bodily imaginative and prescient board, you’ll want to choose photographs and phrases that encourage and encourage you.

Nevertheless don’t neglect about numbers! Along with charts and graphs alongside the seen components in your imaginative and prescient board might assist make it far more specific to your targets.

Now, when you’re inserting collectively a financial imaginative and prescient board, you may additionally embody money monetary financial savings charts. Money monetary financial savings charts are charts that present you learn how to with monitoring monetary financial savings for specific targets.

For instance, if thought of considered one of your intentions is to repay debt, you can presumably embody a debt payoff coloring chart that tracks your progress. Every time you make a value, mark it in your debt payoff chart—and watch your imaginative and prescient board grow to be your actuality!

These charts come is numerous completely completely different sorts and codecs. You presumably may even design your particular person. My favorite money chart is the thermometer format.

4. Place your imaginative and prescient board someplace you’ll see it day-to-day

The aim of constructing a imaginative and prescient board is to have seen inspiration for the targets that we’re making an attempt to carry out.

That talked about, your board should be in your imaginative and prescient truly. In numerous phrases, you could put it someplace you’ll see it day-to-day!

So suppose: What place do you most frequent in your own home? That’s exactly the place your imaginative and prescient board should be.

Put your board in a spot the place you’ll see it day-to-day. That method, it’ll perform a day-to-day reminder to proceed working in the direction of your imaginative and prescient.

Ponder areas like your mattress room, office, and even your fridge door. You presumably may even take {a photograph} and make it the screensaver in your cellphone or laptop computer desktop. I’ve mine as my cellphone screensaver and as well as in my residence office.

Furthermore, now that you simply simply’ve created your imaginative and prescient board, take a second to analysis it. Is there one thing that you simply simply want so as to add? Do you feel motivated?

Do you have to haven’t already, add phrases and money affirmations that align collectively together with your targets.

5. Maintain motivated by web internet hosting a imaginative and prescient board social gathering

Everybody is aware of that there’s a complete lot of temptation to spend and, thus, a complete lot of temptation to stray from our money intentions.

So, to help your self maintain motivated and on monitor, ponder web internet hosting a celebration.

Accumulate buddies collectively who’re moreover centered on enhancing their non-public funds. You presumably can spend the day collectively outlining your targets, lowering out photographs, and creating your imaginative and prescient boards. Then, you’ll look at in with each other month-to-month to adjust to up in your progress.

Think about it or not, this sense of accountability can go an amazing distance in serving to you receive your targets. As Forbes explains, “…accountability groups can positively have an effect on exercise effectivity and academic effectivity.”

6. Monitor your progress with a money journal

Making a board for money targets is an effective method to get impressed and energized to start working within the route of your long-term financial targets. Nevertheless over time, it’s easy to lose just a few of this preliminary momentum.

A technique to help your self carry on monitor collectively together with your non-public funds is to start a money journaling conduct.

Money journaling is additional than merely writing down what you spend and save each month. It’s moreover a spot to take notes on the best way you actually really feel about your spending and saving, your concepts in your funds, and your observations in your goal-tracking.

Don’t suppose journaling is worth the extra step? One look at discovered that those who write their targets are 42% additional extra more likely to really accomplish them.

7. Edit as you go

One different strategy to observe your progress in the direction of your financial targets is to edit your money imaginative and prescient board.

We already talked about together with money monetary financial savings charts. Nevertheless if you happen to occur to’re not a facts-and-figures specific particular person, there’s nonetheless one different method you’ll monitor your progress visually in your board.

As an illustration, suppose you’ve added three targets: 1) Repay financial institution card debt; 2) Start emergency fund; 3) Open retirement account.

Every time you meet a goal, you’ll draw an infinite inexperienced checkmark subsequent to it. For one, drawing this checkmark will most definitely actually really feel satisfying. (You notice that feeling of crossing an merchandise off your to-do document?)

Plus, it’ll be one different seen reminder that you simply simply are making progress in your targets—which supplies you additional motivation to keep up going.

8. Ponder creating numerous imaginative and prescient boards

If you’ve received a complete lot of completely completely different financial targets, making a number of imaginative and prescient board would possibly make sense.

Listed beneath are just some completely completely different ideas:

As an illustration, suppose thought of considered one of your targets is to keep away from losing up for a down value to develop right into a first time homebuyer. That may be the subject of 1 board, the place you’ll embody photographs of your dream dwelling and scary quotes about homeownership.

On the same time, you might want one different financial goal to spend a lot much less each month by adopting minimalism. On this imaginative and prescient board, you’ll give consideration to minimalism.

Write down minimalist quotes to remind your self that a lot much less is additional, and in addition you don’t need to buy that new robe this month. You’ll be able to too embody a chart the place you document the entire belongings you wanted to buy nonetheless didn’t to congratulate your self in your willpower—and maintain the great work!

Imaginative and prescient board ideas

In case you might be nonetheless stumped on what to include in your imaginative and prescient board, you’ll always uncover inspiration on web sites like Pinterest. Doing a quick Google search might even lend some examples as correctly. Don’t forget that your imaginative and prescient board is unique to you, so solely use them as inspiration.

Journey occasion

Proper right here is an occasion of a financial imaginative and prescient board I created numerous years prior to now. On the time I was on my debt-free journey. I moreover wanted to get financial financial savings, overcome funds challenges, and funds efficiently so that I’d journey the world.

As you’ll see, I included phrases like “saving money,” “debt-free,” and “funds” on my money imaginative and prescient board as a reminder of what I was working in the direction of. I moreover included flags and cutouts of varied worldwide areas I wanted to go to as quickly as debt-free.

If you’ve received a keen eye, you’ll uncover that debt-free is crossed out and that there’s a checkmark beside the phrase funds. There’s moreover a 12 months beneath the flag for the UK. That is on account of I was able to really accomplish these items!

After getting on a funds, I’d repay debt, get financial financial savings, and journey abroad. There are nonetheless numerous flags and worldwide areas that don’t have a 12 months beneath them, which suggests it’s nonetheless one factor that I’m working in the direction of.

Though this board is numerous years earlier, I nonetheless maintain it shut by as a reminder of the problems that I nonetheless want to perform financially.

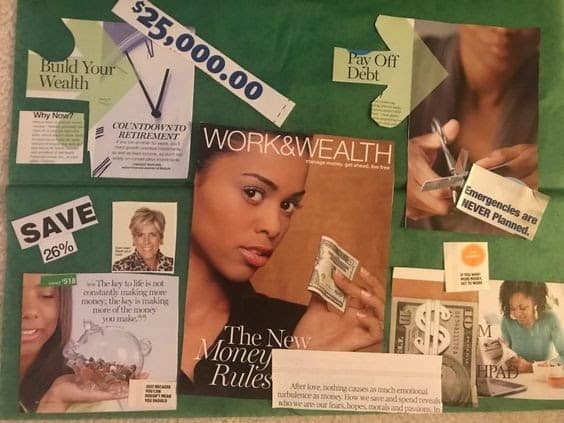

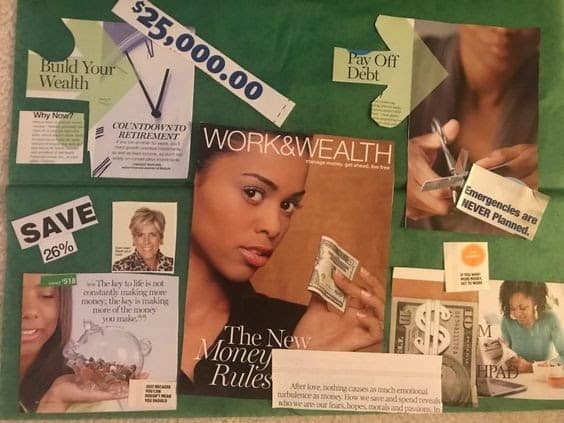

Debt-free & monetary financial savings occasion

In case your goal is to grow to be debt-free, this is a debt-free imaginative and prescient board occasion. As you’ll see, this board consists of photographs of any individual lowering up a financial institution card and a monetary financial savings goal of 26%. It’s a very vivid illustration of their financial targets.

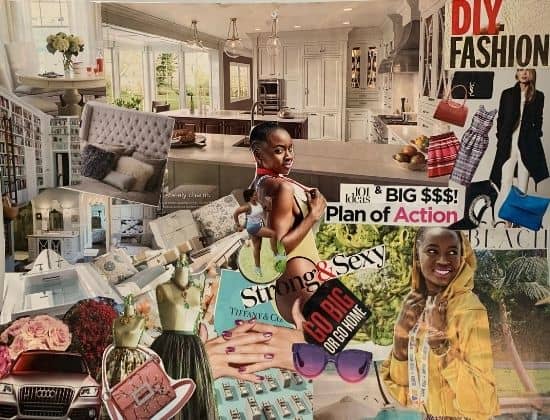

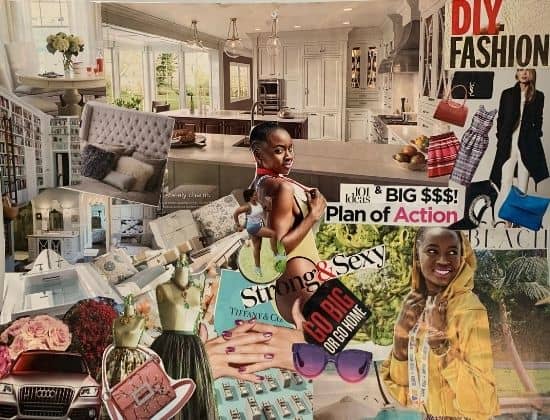

First residence occasion

Need some inspiration for looking for a house for the first time and even your dream dwelling? Proper right here’s my latest board that options photographs of residence components I plan to have.

The board moreover consists of photographs and a phrase related to money. That’s on account of I’ll need to have money saved and a plan of movement to realize this new financial goal.

Investing & early retirement occasion

Are you interested in retiring early? Check out this simple imaginative and prescient board.

Investing and retiring early usually go hand in hand. That’s on account of if you happen to occur to could make investments strategically, you’ll withdraw out of your investments to retire early. Examine additional about what it means to receive early retirement.

As a reminder, these examples are all meant to encourage you. Uncover what motivates and conjures up you when creating your board.

Skilled tip: Maintain a optimistic money mindset

It’s clear that establishing a imaginative and prescient board can play an infinite half in serving to encourage us to work within the route of our money targets. Nevertheless don’t neglect to technique it with one of the best financial mindset.

In the end, learning how one can create a mindset of financial abundance might enable you to perceive your targets.

Whether or not or not you’ll want to save a positive sum of cash, retire early, buy a house, and so forth., a mindset of financial abundance helps you remember the fact that the targets in your imaginative and prescient board are achievable—and that with one of the best planning and movement, you too can make them come true.

How do you format a imaginative and prescient board?

There are a variety of different methods to format a imaginative and prescient board, nonetheless the 1st step is to always clearly define and set your fast and long-term targets.

You’ll be able to do that digitally, with a Phrase doc, a spreadsheet, or just your Notes app. Or you’ll go old-school and easily start writing on a clear piece of paper with a pen. You presumably may even get creative and color-code your money intentions with a marker.

After what your targets are, uncover photographs and phrases that align with them, and add them creatively to your board. It’s all about creating one factor that’s to your liking visually so that when you check out it you feel impressed and motivated. So faucet into your inner artist!

You’ll be able to too uncover good imaginative and prescient board footage and examples on web sites like Pinterest or watch YouTube motion pictures on how one can create a imaginative and prescient board.

What questions do you need to ask your self when making a financial imaginative and prescient board?

Making a financial imaginative and prescient board isn’t almost lowering out photographs of belongings you’ll want to buy. As a substitute, you must take the time to sit down down and really assess your non-public funds and your targets.

You presumably can ask your self questions as they related to your financial targets. As an illustration, ask your self:

- Do I’ve debt I have to repay? How shortly do I have to pay it off?

- Do I have to assemble an emergency fund? How lots do I need to keep away from losing?

- I would like to save lots of for my kids’s college education with a 529 plan; What would that value?

- Am I saving ample for retirement? How do I bridge any gaps?

- How do I alter my retirement strategies to retire at 50 instead of 65?

- What does my dream residence seem like? What views do I have to see from the house home windows?

Questions like these might enable you to get clear on what you’ll want to place in your imaginative and prescient board.

Articles related to having a plan in your money

If that having a imaginative and prescient board will present you learn how to collectively together with your money, these completely different posts might even encourage you!

Understanding how one can create a money imaginative and prescient board might enable you to improve your funds!

Money imaginative and prescient boards are an particularly priceless software program for serving to you attain your financial targets. They’re moreover a pleasant practice, and you might get as creative as you want when making your particular person.

The fact is that merely writing your targets down and visualizing them obtained’t robotically present you learn how to receive them. You must moreover do the necessary (typically laborious!) work and keep your self accountable.

Probably the greatest methods to do this is to embody your self with others working in the direction of associated targets. You presumably may even get an accountability confederate to work alongside side you.

If a neighborhood is what you’re missing in your financial journey, then attempt the Clever Woman Finance applications and neighborhood. Proper right here, you’ll uncover the property and accountability you must obtain success collectively together with your money.

[ad_2]

Provide hyperlink